The Development Center for Finance (DCF) successfully conducted another run of the Risk Management Seminar in 2025 with participants representing various organizations and industries. The virtual sessions were held via Zoom on May 31, June 14, and June 21, 2025.

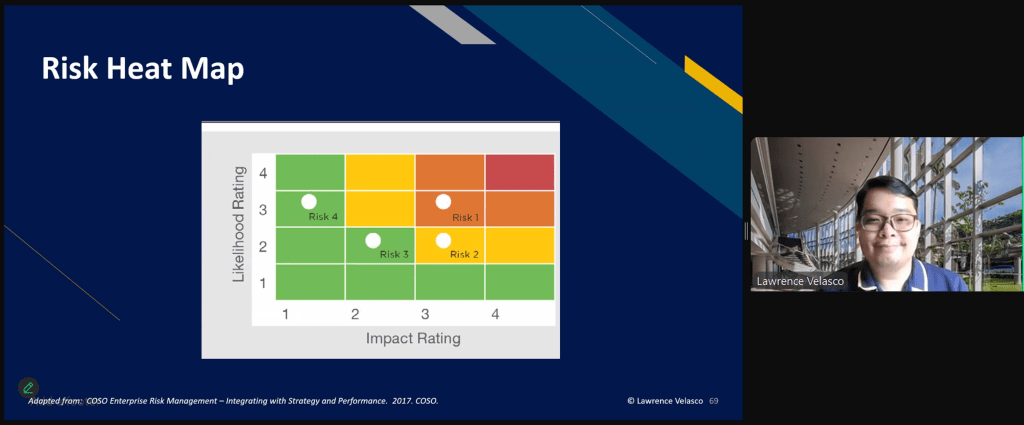

The seminar started with Mr. Lawrence Velasco, who laid the groundwork with an introduction to key risk management concepts on Day 1. He thoroughly defined risk and its classifications before moving into a detailed exploration of Enterprise Risk Management (ERM). Beyond the ERM process itself, the discussion also meticulously covered risk governance and culture, highlighting their paramount importance to the overall risk management strategy. The session concluded by addressing risk monitoring and reporting, with a strong emphasis on the collaborative nature of risk management, asserting it is a shared responsibility across all departments, not solely confined to the risk department.

The morning session of the second day of the seminar featured Prof. Diogenes Dy, who presented important concepts in market risk management. He analyzed the principal causes of adverse price movements and detailed their effective management through derivative instruments such as forwards, futures, swaps, and options, relating the theory to various industry examples.

In the afternoon session, Dr. Arthur Cayanan discussed selected case studies on local companies. These cases were drawn from the “Cases in Risk Management in the Philippines” book, of which Dr. Cayanan is one of the editors. Each participant was given a complimentary copy of the book for their attendance.

Sir Lawrence Velasco opened the Day 3 morning session, where he presented on identifying and managing regulatory risks. He stressed that regulatory risk is highly critical due to its interplay with other areas of a firm’s business.

Sir Diogenes Dy concluded the seminar by transitioning to financial risk, where credit and liquidity risks were prominently featured, along with an introduction to the “5Cs of credit” and credit scoring as vital risk management techniques.

The following are selected feedback from our participants:

“Sir Law is very well prepared, thank you for sharing the reading materials in advance! Relevant examples were provided.”

“Sir Don is clearly well versed on the topics he discussed. Appreciate that he gives examples to illustrate the differences between forwards and futures, options and collars. In this way, it makes us easier to understand.”

“Sir Art taught us how to interpret figures to evaluate the financial position of a company and identify the possible risks and strategies the sample companies made. Wish there were more cases.”